A PLAN TOWARDS FISCAL STABILITY AND ECONOMIC STABILITY (2024)

Issue

Inflation has been relatively sticky for the last year. As a result, the Bank of Canada has elected to raise interest rates. Interest rate increases have impacted many people and will continue to do so. Interest rate increases have resulted in unaffordable mortgages for businesses and homeowners. These high rates also put pressure on the economy, resulting in business closures. The Federal Government has another policy lever to curb inflation: a budget surplus. Instead of increasing the cost of living and attempting to reduce it by creating more debt, the Federal Government should use a lever that has been proven effective, which is balancing its budget and running a surplus. High government spending not matched by sufficient revenue can lead to fiscal deficits. To finance these deficits, the government may resort to borrowing from the central bank or financial markets. When the central bank creates money to buy government debt (monetary financing), it can potentially increase the money supply, leading to inflation.

Background

To curb inflation, Governments may pursue a contractionary monetary policy, reducing the money supply within an economy. The BoC implements contractionary monetary policy through higher interest rates. By increasing interest rates, less money will circulate in the economy by incentivizing banks and investors to buy Treasuries, which guarantee a set rate of return, instead of riskier equity investments that benefit from low rates.

Due to the high levels of inflation, the BoC increased interest rates. The Consumer Price Index (CPI) has steadily decreased in some respects, but this is primarily due to geopolitical circumstances such as the war in Ukraine that was impacting oil prices. The domestic impact of interest rate increases has caused bank lending rates to increase, which has caused the cost of living to inflate dramatically.

Given that CPI includes prices of oil and groceries, which are imported commodities not significantly affected by domestic policy, there is a school of thought that government spending can curb inflation. Some say that during inflation, the government should have a surplus. During a recession, a government should spend money to stimulate the economy. So, during inflationary periods, governments should reduce spending, ultimately reducing the money supply, to bring inflation down.

However, the information below shows the Government of Canada’s spending and budget deficits during inflation:

2021 Budget | 2022 Budget | 2023 Budget |

$90.2 billion deficit[1] | $43.0 billion deficit (updated forecast) | $40.1 billion deficit (budgeted) |

In the 2023 Q1 report, it was noted that over the previous four quarters, the Federal Government deficit decreased by $54.8 billion compared with the same period a year earlier to stand at $27.2 billion. Both an increase in revenue (+$25.2 billion), driven by nominal GDP growth (+8.7%) and a decrease in expenses (-$29.6 billion) contributed to the deficit reduction. Although total Federal Government expenses decreased, interest expenses increased by $8.3 billion as interest rates rose sharply.[2]

The aggregate principal amount of money the government will borrow in 2023-24 is projected to be $421 billion, about 85% of which will be used to refinance maturing debt.[3]

The Inflationary Effects of Higher Debt and Excess Spending

The link between excessive public debt and inflation is well-documented in economic literature. Studies such as the research by Reinhart and Rogoff (2010) have shown that when a country's debt-to-GDP ratio exceeds a certain threshold, usually around 90%, economic growth slows down, and inflation rates tend to increase.[4] This suggests that the continuous accumulation of debt and unrestrained spending can lead to inflationary pressures, adversely affecting the overall economy and reducing citizens' purchasing power.

Fiscal Surplus as a Measure of Economic Prudence

Contrary to the inflationary impact of high debt, fiscal surplus acts as a powerful economic stabilizer. A research report by the International Monetary Fund (IMF) in 2018 revealed that countries with prudent fiscal policies, characterized by running surpluses during periods of economic expansion, were better equipped to weather economic downturns with lower inflation rates. Building fiscal reserves during times of economic growth allows governments to stimulate the economy during downturns without resorting to excessive borrowing, which can mitigate inflationary pressures.

Striking the Right Balance

Pursuing fiscal surplus should be balanced with responsible spending in crucial areas such as infrastructure, education, and social welfare. By strategically allocating funds to areas that contribute to long-term economic growth and social development, the government can bolster the economy while maintaining fiscal discipline.

Building Economic Resilience

In a globally interconnected and unpredictable economic landscape, a fiscal surplus provides an essential buffer against potential shocks. The ability to respond to unforeseen events, such as economic downturns or natural disasters, without resorting to inflationary measures or excessive borrowing, is crucial to safeguarding the nation's economic well-being.

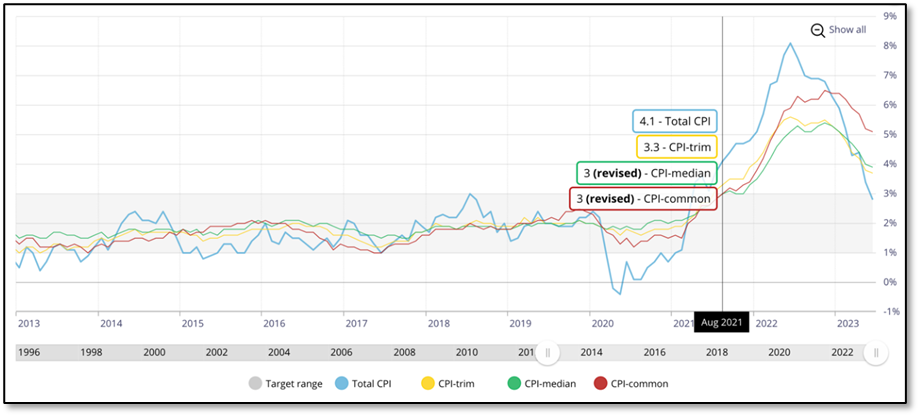

Future inflation levels should be better monitored, and action should be taken by the Central Bank expeditiously. Based on Chart 1 below, it is evident that CPI-trim, CPI-media, and CPI-common (the three indicators the Central Bank uses when determining interest rate increases or decreases) were edging above the targeted levels in August of 2021. Although Canada’s GDP was at a modest 0.4% growth (monthly change) in August 2021[5], the trend in the graph below shows a clear trajectory of CPI towards an unsustainable level. This was the opportune time to begin increasing interest rates to cool inflation.

Chart 1: Total CPI, CPI-trim, CPE-median, CPI-common and Target Range

Source: Key inflation indicators and the target range, Bank of Canada[6]

Monetary Policy Framework Renewal

The Bank of Canada and the Government of Canada work together to set the Bank of Canada’s monetary policy tools for the next five years.[7] This document sets the Bank of Canada’s ability to influence monetary policy. The previous monetary policy framework highlights a focus on interest rates as the primary means of correcting inflation.

THE CHAMBER RECOMMENDS

That the Federal Government:

- Should adopt a fiscal anchor and budgetary framework that ensures Federal Government spending is aligned with the goals of monetary policy to ensure low and stable inflation rates. This means reducing ineffective and inefficient spending, as well as the growth of spending and targeting budget surpluses during normal economic times.