A SUSTAINABLE APPROACH FOR TRANSIT AND MAJOR ROAD FUNDING IN BC (2025)

Issue

Access to public transit and safe roads is critical for businesses and individuals across British Columbia, supporting local and inter-regional travel. However, the current funding model relies on a patchwork of property taxes, gas taxes, and user fares, which are becoming unsustainable. To meet provincial climate goals, ensure safe and efficient travel, and reduce roadway congestion, it is essential to adopt a more sustainable and reliable funding mechanism.

Background

Robust public transportation is not only essential to its direct users, who may hop on a bus to get to work, to school, or home safely from a night out; it is critical for every road user – from the truck driver bringing lumber to the ports, to the daily single occupant vehicle commuter. Public transit alleviates congestion within cities and regions, while providing a means of workforce, consumer, and social participation for those who do not drive. Investments in public transit reduce commute times, enabling greater labour market participation and enhance productivity. [1]

The BC Chamber network and other business organizations have long recognized the vital connection between a robust public transit system and business success. Existing BC Chamber of Commerce policy proposals—“Transportation Demand Management Solutions for BC’s Industrial Areas and Business Parks” (2024) and “Protecting Public Transit in BC as an Essential Service” (2024)—have already made the case for sustainable transit investment across the province, including routes that primarily serve employment centres.

Further reinforcing this argument, an economic impact analysis by the American Public Transportation Authority found that a sustained increase in public transit investment yields significant economic benefits. Over a 20-year period, every $1 billion invested annually is projected to generate approximately $5 billion in additional GDP, including $3 billion from productivity gains and cost savings and $1.8 billion from direct investment spending. At current wage rates, this translates to roughly 49,700 jobs per $1 billion invested in public transportation. [2]In the Metro Vancouver region, the South Coast British Columbia Transportation Authority (commonly known as TransLink) publishes ridership data. In October 2024 alone, an estimated 21, 840, 000 bus boardings occurred[3]. What would our roads look like if those millions of journeys took place in single passenger vehicles instead? Outside of the urban area, we see the decline in safety and access that can occur when public transportation is not adequately funded. British Columbia’s infamous ‘Highway of Tears’ was inadequately served by transit for many years, leading people to hitchhike along the stretch of Highway 16 between Prince George and Smithers. After the disappearances of at least 18 women, and over a decade of advocacy by indigenous communities, a route was finally opened in 2017[4].

As public transit is so impactful to a region’s economic and social health, surely it is funded appropriately. Unfortunately, that is not the case. Public transit funding models vary throughout the province. In Metro Vancouver, TransLink is primarily funded through a mix of taxes, including a regional 18.5 cent/ litre gas tax, parking tax, property taxes, and fares. In most of the rest of BC, transit service is provided through a partnership between BC Transit, local government and a contracted transit operating company. Regional transit system service levels and budgets are approved each year by local government, who also set fares and local property taxes to pay their contribution of transit costs. [5]In both examples, a significant percentage of transit funding is subject to political motivation, including the willingness (or lack thereof) to raise local property taxes.

In Metro Vancouver and Greater Victoria, where a gas tax (18.5 cents and 5.5 cents per litre respectively) supports the public transit network (and major road network maintenance), road users are paying for road use. However, zero-emission vehicle (ZEV) adoption has already curtailed that source of revenue, even as the population grows, and congestion increases. With the CleanBC Roadmap target that 100% of new vehicles sold in BC will need to be ZEVs by 2035, revenue will continue to drop, ultimately nearing zero.

However, the notion that road users should pay for road maintenance, and initiatives that reduce congestion is supported by the research. All road users benefit from the reduced congestion that public transportation provides (including those driving ZEVs).

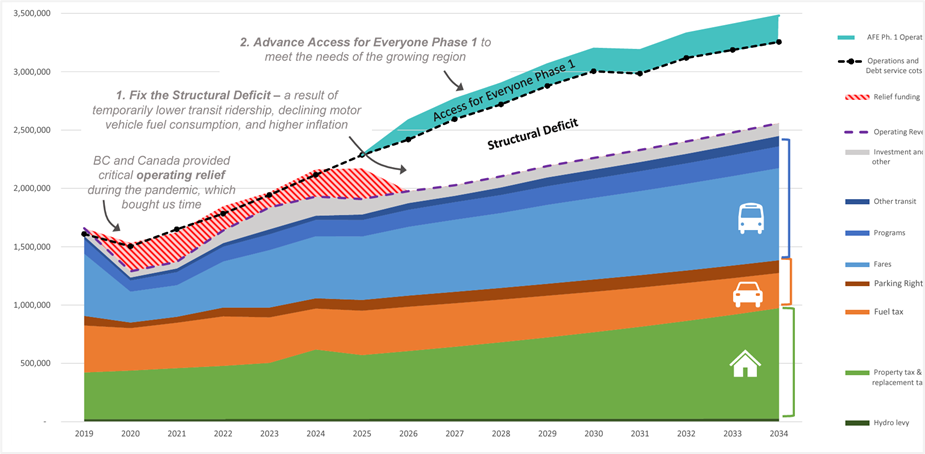

For TransLink, which serves over 50% of all British Columbians[6], this shortfall is being felt acutely. In summer 2024, the organization projected an estimated $600 million operating deficit for their year-end, which modelling showed could result in a 50% reduction in bus service, 30% reduction in SeaBus services, 30% reduction in SkyTrain service, and a complete cessation of the West Coast Express in 2026, if the deficit was not supported by additional funding. [7] Despite rising costs of labour, energy, and equipment, TransLink fares have remained below inflation since 2020 at the direction of the province.

In areas without a gas tax, which are more reliant on property taxes, all property owners can see large increases to support public transit services (even if they never leave their homes in a car or a bus). The 2025 provisional budget for the City of Kamloops includes a 9.67% property tax increase, amounting to about a $241 increase for the average household. Much of this increase has been attributed to rising costs in contracted services, including those related to BC Transit. [8]

Figure 1

The Interior region of BC also displays a patchwork of public transit coverage ranging from inadequate to non-existent. Yet, there are post-secondary institutions throughout the province; there are many who require public transit to get to medical appointments, shop, see friends, and get to work. Taxis and Uber are not the answer. One example is that Kelowna has been the fastest-growing CMA (census metropolitan area) in Canada for five years, yet transit is woefully inadequate to serve its growing population and busy tourist economy. These challenges exist throughout the province.

It's clear that British Columbians need a funding mechanism for public transit that is consistent and equitable across all road users, while eliminating the patchwork of taxes that can leave some areas inadequately funded or facing volatile cost increases. One solution for this would be an annual vehicle levy, paid alongside a driver’s annual ICBC renewal, with revenues supporting major road maintenance and public transit operations within the region where the vehicle is registered. Tying revenue to region is critical, as a driver in the Kootenays certainly should not be subsidizing the Canada Line in Richmond and Vancouver. This would also allow local governments and regional bodies to address critical needs and bus routes necessary to serve their communities, while continuing to incentivize the move away from personal vehicles toward transit use. It would also acknowledge the disparity in service and costs that exist in various regions of BC.

THE CHAMBER RECOMMENDS

That the Provincial Government:

Develop and implement a long-term, sustainable funding model for public transit that is equitable across all regions of British Columbia, resilient to volatility in fuel tax revenues, and applies best practices to enable better transit service.

Work with regional transportation authorities to ensure that funding mechanisms reflect local priorities and economic needs, while enabling flexibility to address service gaps in fast-growing or under-served communities.

Support transit fare structures that can evolve in line regional and economic needs, while maintaining affordability and encouraging increased transit ridership.

[1] C.D. Howe Institute. (2013). Cars, Congestion and Costs: A New Approach to Evaluating Government Infrastructure

Investment. C.D. Howe Institute.

[3] https://www.translink.ca/plans-and-projects/data-and-information/accountability-centre/ridership#boardings-by-service-type

[4] "A Long Time Coming: Highway of Tears Gets 2 New Bus Routes," CBC News, June 19, 2017, https://www.cbc.ca/news/canada/british-columbia/a-long-time-coming-highway-of-tears-gets-2-new-bus-routes-1.4166749.

[5] BC Transit. "Funding and Governance: Regional Transit Systems." BC Transit. Accessed January 17, 2025. https://www.bctransit.com/about/funding-and-governance/regional.

[6] Government of British Columbia. "British Columbia Population." Environmental Reporting BC. Accessed January 17, 2025. https://www.env.gov.bc.ca/soe/indicators/sustainability/bc-population.html

[7] TransLink. Potential Transit Impacts on the Public. July 2024. https://www.translink.ca/-/media/translink/documents/about-translink/governance-and-board/council-minutes-and-reports/2024/july/report_2024-07_potential_transit_impacts_public_mc.pdf.

[8] Castanet Kamloops. "Provisional City of Kamloops Budget Includes 9.67% Tax Hike, $241 for the Average Home." Castanet Kamloops. December 10, 2024. https://www.castanetkamloops.net/news/Kamloops/518293/Provisional-City-of-Kamloops-budget-includes-9-67-tax-hike-241-for-the-average-home