- Home

- Policy Search

- ADDRESSING BARRIERS TO SUCCESSION PLANNING FOR SMALL TO MEDIUM ENTERPRISES (2025)

ADDRESSING BARRIERS TO SUCCESSION PLANNING FOR SMALL TO MEDIUM ENTERPRISES (2025)

Issue

76% of small business owners are planning to exit their business over the next decade, with 75% of these planning to retire. Anticipating the generational shift, Succession Planning is key—but only 34% of Canadian family businesses have a robust, documented and communicated succession plan in place. SME businesses need professional support and moderation to address them properly[1]. Anticipating the generational shift, Succession Planning is key—but only 34% of Canadian family businesses have a robust, documented and communicated succession plan in place. SME businesses need professional support and moderation to address them properly[2].

Background

Innovation, Science and Economic Development Canada defines an SME when a business employs anywhere from 1 to 499 employees, which includes Micro-enterprises employing 1 to 4 individuals.

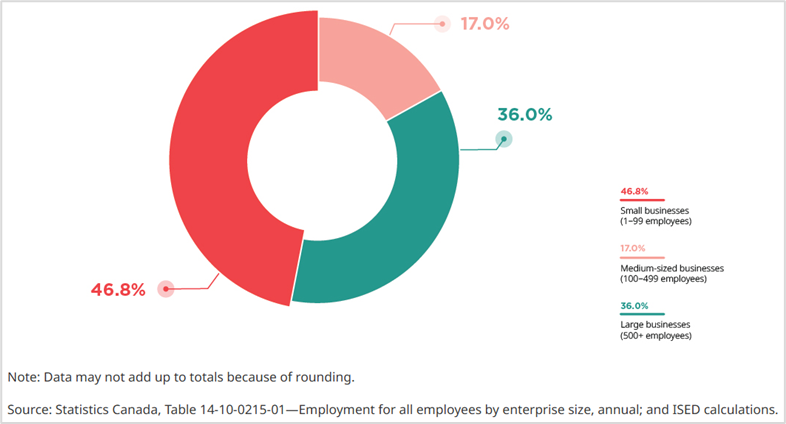

In Canada, as of 2022, small businesses employed 5.7 million individuals, or 46.8 percent of the total private labour force (see figure 1 below). By comparison, medium-sized businesses employed 2.1 million individuals (177 percent of the private labour force) and large businesses employed 4.4 million individuals (36 percent of the private labour force). Between 2021 and 2022, small businesses were responsible for 41.1 percent of the net employment growth in the private sector, which increased by approximately 802,550 jobs. Medium-sized businesses contributed 18.3 percent of this net employment growth and large businesses contributed 39.4 percent.[3]

Figure 1: Distribution of private sector employees by business size, 2022[4]

From 2024 to 2034, the BC Labour Market Outlook analysts project 1,120,000 job openings in British Columbia. 60 per cent of these will be a result of workers leaving the workforce to retire. In addition to the pressures of transitioning our businesses to the next generation, the population and the labour force will continue to age, and employers will need to replace retiring workers at an increasing rate. In addition to the pressures of transitioning our businesses to the next generation, the population and the labour force will continue to age, and employers will need to replace retiring workers at an increasing rate.

To ensure business owners successfully accomplish the transition of their business, it is essential to have the necessary tools and resources at their disposal.

A succession plan helps a business owner deal with complex topics such as:

- tax issues;

- required qualifications and skills of successors;

- legal issues;

- how the successor will be trained/prepared for the role; and

- mechanics for the purchase or transfer.

Some of the top barriers to succession planning include but are not limited to:

- finding a suitable successor;

- valuing a business;

- financing for the successor; and

- access to cost effective professional advice.

British Columbia’s Venture Connect program offered through Community Futures prepares businesses for a sale so they can be transferred to a new owner – keeping businesses in our communities. Venture Connect began as a project created in response to the challenge that over the next 20 years, there will be unparalleled shortfalls of both business owners and employees resulting in potential closure of large numbers of small businesses throughout the province. Even with resources such as Venture Connect, SMEs have historically been, and continue to be, vulnerable with respect to receiving approval for financing from lending institutions. This not only includes entrepreneurs starting a brand-new business, but also those looking to purchase an existing business, as in the case of succession.

Under the direct investment model, a small business in BC can register as an eligible business corporation (EBC). EBCs can accept equity capital directly from investors without having to set up a venture capital corporation (VCC). This investment structure is intended to assist investors planning to be actively involved in the growth of a small business[5]. However, the current program is not inclusive towards small and medium size businesses involved in a succession transaction.

Continued government funding towards existing, revised and new programs that support business owners transitioning their businesses, is imperative to maintaining a healthy economy.

On June 29, 2021, the Senate approved Bill C-208, which attempts to correct “unfair” income tax impacts that can arise when shares of private businesses are transferred to family members.

Prior to Bill C-208, individuals were generally financially incentivized to sell the shares of their business to an arm’s length party rather than to the next generation[6].

Bill C-208 facilitates intergenerational transfers by excluding the application of the punitive deemed dividend rules on transfers of a qualified small business, family farm or fishing corporation to a related party, provided that the purchasing corporation is controlled by one or more children or grandchildren over the age of 18, and the purchasing corporation does not dispose of the acquired corporation within 60 months of the transfer[7].

On July 19, 2021, the Federal Department of Finance announced that it proposes to introduce additional amendments to Bill C-208 due to concerns that it may inappropriately facilitate tax-motivated business transfers within families, where there is no intention of having the business carried on by the next generation such as:

- the requirement to transfer legal and factual control of the corporation from the parent to the children or grandchildren

- the level of ownership in the corporation that the parent can maintain after the transfer; and

- the requirements and timeline of the transition of the business of the corporation from the parent to the children and grandchildren, and the level of involvement of such children or grandchildren in the business after the transfer.

Bill C-59 received Royal Assent on June 20, 2024, expanding the definition of “child” to include adult nieces, nephews, grandnieces and grandnephews[8]. While these are significant advances in reducing the burden on businesses looking to transfer their business to the next generation, more needs to be done to support business owners with the appropriate tools and legislative reform to keep the doors of our businesses open.

Since 2013, several tax measures have been introduced to assist Canadian business owners with the transition of their businesses. The Lifetime Capital Gains Exemption (LCGE) is one very important tax measure because for many business owners, the sale of their business is their retirement income.

The Lifetime Capital Gains Exemption limit, for sales of small business shares and farming and fishing property, increased to $1.25 million as of June 25, 2024, and will be indexed to inflation going forward (beginning in 2026). The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs’ Incentive has been introduced. This has a lower 33.3% inclusion rate on up to $2M on the sale of business shares in qualifying sectors (starts at $200K in 2025, rising by $200K each year to reach $2M maximum by 2034), and a higher inclusion rate of 66.7% for all capital gains within a corporation or for sales of business shares above other exemptions or reductions.

Ineligible businesses include:

- Finance and Insurance

- Real Estate

- Food and Accommodation

- Arts, Entertainment, Recreation

- Personal Care Services

- Professional Corporations[9]

Amending the LCGE to include all SMEs attempting to legitimately and lawfully transition their businesses to the next generation will help to counterbalance the forecasted labour shortages, increasing retirement levels and assist with keep our businesses open and our communities strong during these challenging times.

It would be prudent for government to focus on stimulus for succession planning for small business that addresses the various business structures while keeping in mind that vendor’s general desire to use the Federal Tax Act provisions to minimize tax on the transition.

Overall, there is a continued need for awareness to the issue of succession planning for SMEs as well as additional changes to existing government resources, programs and legislation to provide sellers and potential purchasers the incentives to conduct succession planning and transition their businesses effectively.

THE CHAMBER RECOMMENDS

That the Provincial and Federal Governments:

- Review the current “qualifying activities” in the existing Eligible Business Corporation (EBC) program and:

- Include a clause that allows the program to be more inclusive towards small- to medium-sized businesses in a succession transaction.

- Include a vendor-financed arrangement as a qualifying activity, whereby the vendor will receive the same 30% tax credit for financing the business succession transaction, thereby reducing the vendor’s risk.

- Expand the scope of existing small business financing programs to incorporate succession planning as a legitimate reason for small business financing.

- Allow small corporations to defer the tax on the capital gains from the transfer of a business to the owner’s children.

- Increase the Lifetime Capital Gains Exemption amount to $1.25 million, indexed for inflation, for all SMEs.

- Ensure that future amendments to the Income Tax Act do not impede legitimate and lawful intergenerational transfers of small businesses to family members and are considered with terms that are, at minimum, equitable with those when transferred to any third party.

[3] https://ised-isde.canada.ca/site/sme-research-statistics/sites/default/files/documents/2023-ksbs-en.pdf

[4] https://ised-isde.canada.ca/site/sme-research-statistics/sites/default/files/documents/2023-ksbs-en.pdf

[5] https://www2.gov.bc.ca/gov/content/employment-business/investment-capital/venture-capital-programs/eligible-business-corporation